I saw an article yesterday that said that banks this year have made a record profit from the charges they “extort” from their customers. I’m not sure when and why this started, but it is totally unacceptable, from most people’s point of view.

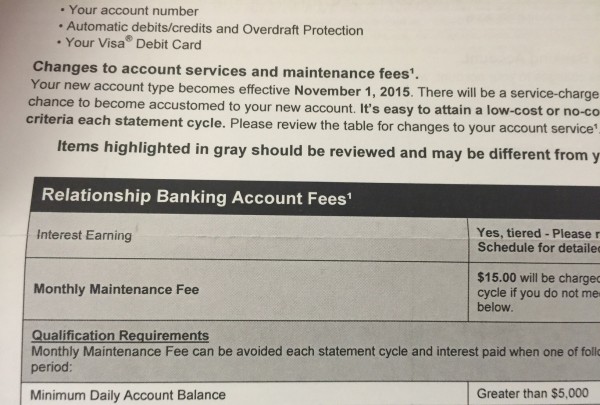

After reading this, I opened my mail, when I got home last night, and my bank sent one of those letters citing changes they were making. One of those letters that no one reads. One of those letters that spews how great these changes are going to be. And buried in the print is a line saying that if I don’t keep a minimum daily balance of over $5000 in my checking account, I’ll be charged a $15 service charge. WTF?

Okay, this is total bullshit. Very few people keep a balance of $5000 in their checking accounts. Actually, over 60% of the US population doesn’t have $5000 to put into a checking account. I saw this article from the Wall Street Journal that says that 62% of the population doesn’t have $1000 in their saving accounts. So obviously they don’t have $5000 to put into my bank, so they can avoid the service charge. Think about it, if they have 100,000 people with checking accounts, times $15, then they make 1.5 million dollars a month. What this really is – a poor tax.

I’ve been charged a few service charges over the years and have found it impossible to get one removed. I’d bet a ton of people get this charge on their account for months upon months, with virtually no chance of getting their money back. Plus, if you do have $5000 in your account, they will pay something like .01% interest.

They realize that we all have our checking accounts tied to lots of automatic payment systems. I pay so many credit cards, insurance etc. They sort of have us in a tight spot in this respect.

I guess this all means that 62% of the population of our country couldn’t use my bank without incurring a $15 monthly fee. I’m going down there today and talk to them about the “no fee” checking account. If they don’t have one, I’m withdrawing my money. I’ve used the same back for decades. But, this practice is unacceptable and we, as citizens, need to make sure that banks, and such, understand that we don’t approve of their business practices. Thus, we walk.

My bank did that, so I went down and said I wanted to close all my accounts, and voila, the charge was dropped and they changed my account to one with a far lower balance requirement. (I’m sure it helped tons that my accounts were linked to my mortgage.)

You may find that there’s a local credit union that will give you the services you need without charging as much or without the same balance requirement.

People knock payday loan places for there high interest rates but if you treat overdrafts, and other bank charges as interest on short term loans the rate is way higher. 17,000% to borrow $24

http://www.huffingtonpost.com/gobankingrates/why-a-third-of-americans-_b_6024488.html

All of my automatic payments come from my savings account. It is a bit harder to find the account number since it is not on your check but you can call your bank and get it.

If you have BMO Harris around you, good bet. We switched all our accounts there mainly for the reason you point out. Painless banking with free bill pay, even them mailing checks, and no fees on Everyday checking. One of the mover and shaker banks but operates fairly. Daughter just went to school in LA but kept her BMO account here. Even without a local branch you could likely do the same.

Not too defend the bank, but this is entirely tied to federal interest rates. If the banks have no way to make money in appreciation, they’ll have to charge their customers.

That’s the reason I switched our accounts over to our local Credit Union. Haven’t looked back. Still have online banking, Bill Pay, direct deposit, debit cards, credit cards…. Just not with the regular bank anymore. Yeah, it was a pain, but worth it in the end.

I find credit unions are much more consumer-friendly than banks. I’ve never had a bad experience in dealing with a credit union. I see no downside to credit unions for the average consumer.

That’s why the term BANKSTERS has become popular. Especially when you get all the automatic payment stuff set up they know you’ll probably just let ’em stack up the various fees because it’s not as bad as going through all the hassle of pulling the plug on your account, setting up a new one and then setting up all new automatic payment schemes. Then of course they tell you they must extort all these fees because the “shareholders demand it”. And even if you do find a bank that won’t extort the fees from you at the start, you can bet they’ll try it later once you’re seriously involved with them. The final insult is when they get caught and punished for financial chicanery or screwing their customers, the fines they pay amount to barely ” one second’s income shot to hell” and the costs get paid by the shareholders/customers while the banksters keep on getting their fat salaries!!!

They make money on the difference between interest rates-that at which they borrow from the Feds or depositors, and the people that borrow from them. They make plenty of money off that difference. The problem is greed-the executives and investors think they should be making more money. As Steve notes, they’ve found they can get away with this kind of nonsense.

Yet another vote for credit unions. It can be tough to find one that you qualify for as you have to have some membership affiliation (e.g. be employed with a big company or relative of such a person). I found one that I joined after I made a one-time $5 payment to join a state consumer group. Of course doing this is daunting for a lot of people and hence they either stick with their bad bank or they don’t have a bank at all which costs them lots of money when they need to send payments to someone. Banking reform is something Congress ought to work on.

I say Credit Union all the way. Credit Unions have been allowed to relax their membership rules quite a bit. Almost anyone can join one nowadays. It can’t hurt to ask if you qualify to join and if you can’t all they can say is no. Chances are though the answer will be yes.

I love the way banks get essentially free $$$ from the govt and then turn around and loan it out to students at interest rates over 6%. What a great business model.

NOT!

Agree on credit unions. Now I just need to set up online bill pay with mine and dump the bank completely.

Credit union all the way. To get into mine, I just had to open a savings account with a minimum of $50. Then free checking account, debit cards and whatever else needed came with it. They also are very fair on loans. Since I joined the credit union 15 years ago, I have financed several autos through them, and even an unsecured loan for $5k with fair interest that took less than 10 minutes to fill out the paperwork and get the money in my account. I am not a fan of getting hosed by banks. I closed all of my accounts when I was charged a $5 monthly fee for a checking account that hadn’t been active for over 120 days. It had $ in it, just wasn’t active. Kind of like I was “saving” it for sometime when I needed it. 😉

Been saying for years we need a global revolution. We need to kill each and every blodsucking capitalist on this planet b4 anything will change. But is anyone listening? No.

1. Yes, go down to your branch, ask to speak to the manager, tell them you are closing your account because of the fee, and then say nothing else. They should offer you something better, if not, you walk (and credit unions are a good bet, owned by their customers vs shareholders).

2. You shouldn’t be surprised that banks want to charge you a fee for the service they provide. If you think it’s too high, take your business somewhere else. Free checking has not always been the norm. The fee for service is in there somewhere.

3. “Under banked” is a huge hit on lower income groups. They pay a large percentage of their income to fees that just allow them to do basic functions. A credit card and bank account is near mandatory in the US.

4. Dealing in cash has become highly suspicious, your treated with the same respect you get at the airport. Or maybe you’re driving across Kansas and get pulled over, and the police seize your cash just because you have it – http://www.cnn.com/2015/01/21/us/asset-seizures/ . Even with good intentions, regulatory mistakes can occur.

Actually I’ve had good luck with Paypal (15 years now) – your account can be linked to your savings/checking and can also pay your bills automatically – get 1% back when the card is used as a credit card so always at least $15-20 going INTO the account at the end of the month (enough for a 12 pack of Heineken anyway) – NEVER any fees – unless you sell something on eBay and someone sends you money. My bank charges a foreign exchange fee if my debit card is used abroad (this includes purchases made online as well) – but Paypal does not. I pretty much use my checking account to just transfer money to my Paypal account which takes about 2-3 days (banks make money on this also – called the float). Can withdraw up to $400 per day without any ATM fees when used at a point of sale terminal (as a debit card) to get cash back as well.

The credit unions are no better. I use one bank for my checking account and I have always kept a savings account open at a credit union. While looking at my statement from the credit union, I found that they have been siphoning off $5.00 per month. Now, that may not seem like much, but it used to be free and because I only keep the account open in case I need to get a low cost loan, my balance has always been $100-$200. They will in effect clean me out, take all my money and close the account. What a joke! Maybe a crime, too!

I also have a savings account at the federally insured bank where I have my checking account and they charge $10.00 per month if your balance goes under $300. You can get the account for free if you automatically deduct $25.00 from your checking and deposit it into the savings. But why have money in a savings account in 2015? To earn .001%? When I was a kid, you could earn 4%simply by having your money in a bank savings account. Those days are long gone and will never return.

What to do then since my checking account doesn’t earn interest either? I put my “savings account” monies into a discount stock brokerage account where there is no monthly fee and only a small charge for trading. I try to put my money into good solid companies where I can expect to make much more than 4% annually. Currently the market is down, but overall, the strategy works. When the market is down, the opportunities are in buying.

Basically I say screw the banks and their bullshit fees. Put your money into anything that appreciates. Since the banks won’t help you anymore, you need to help yourself.

Ok, I’m not defending the big bad banks. No way. However, if you pay fees, you’re a tool. There are too may ways to avoid them. Direct deposit, online bill pay, etc are services that should allow you to have free checking. And maybe at Steve’s advanced age, he should look into a senior account. Credit Unions don’t pay the same taxes that banks do, hence they’re able to provide lower cost or free services that a bank may not be able to offer. How about credit card or debit card scanning/phishing? There’s a cost to that when millions of $’s disappear. Do you know who ultimately pays for that? One guess and it’s not the banks….yup, you do through fees. And what about your neighbor that overdrew their checking account and said “screw it, I ain’t payin’ it back”. Do you know who pays for that? Yup, you do through fees. It’s a cycle that ultimately you and I pay for through fees. OK, let the ranting and raving continue. I’m out.

Has anyone heard from “The Cyclist” lately? He usually has a reasonable perspective and proposes great ideas………just to be clear, that’s sarcasm. Some people are just too stupid to be taken seriously.

Steve, sadly I have to admit I live vicouisoly through your life style! I’m a true slave to the man. I’ve Been in a few races with you albeit not competitively, I’m more “pack filler”. There are trade offs in life, I am fortunate not to have to “Bank Charges”, but I would trade trade those few dollars in a heart beat to live like you!

Blame your Federal Government for everything about which you complain. The government has slowly but surely increased the cost for banks to do business such that the “net interest margin” (the difference between revenue from loans and the cost of deposits) is no longer sufficient for a bank to even survive, much less make a profit. Similar to the airlines there has been a concerted effort to seek additional revenues from fees in order to help pay for the unbelievable cost the government has imposed upon banks over the course of the last ten to fifteen years. One example is what is called CRA, or the Community Reinvestment Act, which requires that banks lend a certain amount of money into low to moderate income census tracts where delinquency rates are usually very high, along with charge offs. I am not trying to justify all of these fees, because I agree that they are many times egregious. I am, however, suggesting that government imposed regulations are absolutely responsible for banks having to find other ways to make money to offset the ridiculous cost that continue to escalate. In the short term banks might be able to enjoy high margins on these new fees, but long term the free market will bring the charges back down to something more reasonable once other banks charge less for the same service in order to be competitive. Make no mistake, however, these fees are here to stay. Big government is at work and that ultimately cost the consumer more money even though many of the regulations are meant to “protect” that same consumer.

Don – No doubt that is part of the blame. But, let’s not pretend that the banks aren’t making tons of money now. Click on the link below to see the BoA quarterly profits for last quarter. 5.3 billion. Double from a year ago.

Litigation costs and write downs from the investment shenanigans have been their money losers until recently. As interest rates rise, they will start making just that much more money.

This nickel and diming, hidden cost business practice is just that much extra. They don’t need it to cover the costs of governmental regulation. They do it because they can.

And as you said, eventually some of them will because “reasonable” once competition demands it. But in the meantime, bend over.

http://www.nytimes.com/2015/07/16/business/dealbook/bank-of-americas-earnings-surge-in-quarter.html?_r=0

while no fan – at all – of banks and their charges…I’d bet that everyone here who has a mutual account is therefore an “investor” in those banks, driven to maximize profits to maintain return….ahh, the irony!

I have to take exception with Don’s characterization that the government is to blame. Recall that Steve’s original point was the MASSIVE PROFITS posted by banks. MASSIVE PROFITS don’t mean banks are struggling…oh and lest we forget that WE BAILED out the banks for the nefarious behavior in 2008. Should I go on?

I think there are options to avoid fees etc…and I’ll be looking into the option of having my savings account act as my checking account as mentioned earlier….

It’s a fee for the banks service. Why is that so outrageous? Why should everyone be entitled to a free service? You chose that particular institution to do your banking and therefore hold your money, pay you interest, borrow money, invest, etc. I don’t know many institutions or businesses who provide services for free. If they do, they certainly are not a profitable one. Investors (you know the ones who own the bank) expect said bank to make money and be profitable on a quarterly basis. I sure as would not invest in a company who had no revenue stream. See where I’m going here. A bank does not exist to provide anyone free services.

Ah yes, the “bail out.” You idiots do realize that the banks paid back 100% of the borrowed amount IN ADDITION TO INTEREST PAYMENTS (oh crap a fee!!!!). So yeah, the government provided funds to banks to withstand a downturn so that the economy would not collapse. So no one actually received YOUR tax dollars for free and pissed them all away. If you’re going to be mad at someone be mad at the government for loaning your tax dollars and making money on it.

I have BMO business accounts. They charge me for getting change and depositing cash. Around $500 per month in fees.

They extort me to bank there as we have our business loans from them and it is a requirement of the loan agreement. We can’t even pay the loans off early by moving to another bank as there are prepayment penalties.

They make over 100k in yearly interest from our business and we average 100k for account balances.

I don’t have a penny of personal money in BMO and we are switching business banks in 2018…

Needless to say my opinion is pick another bank.

WALK to where?

as wealthy as you are, why did you waste your time writing this post? do you really give a shit about bank charges?

You forgot to tell them that the interest rates on the TARP money were double the street rate at the time and that most big banks did not even want the money. And lest we forget that the majority of the Banks paid back the TARP money on the first day they were allowed to pay it back.

“It’s a fee for the banks service. Why is that so outrageous? Why should everyone be entitled to a free service? You chose that particular institution to do your banking and therefore hold your money, pay you interest, borrow money, invest, etc. I don’t know many institutions or businesses who provide services for free. If they do, they certainly are not a profitable one. Investors (you know the ones who own the bank) expect said bank to make money and be profitable on a quarterly basis. I sure as would not invest in a company who had no revenue stream. See where I’m going here. A bank does not exist to provide anyone free services.”

The fees are outrageous because the banks are taking OUR money and lending it out to make money on the loan interest. As a depositor, I deserve some compensation for the bank’s use of my money. Banks make their money on the margin between the interest they give me for my deposit and the percent they charge on their loans. That’s were the no-fee concept comes in.

Nobody likes to be ripped off but I’ll never understand anyone who expects a service for free. These folks are freeloaders. Do you work for free Mr Tilford ? The bank doesnt. We have choices. Quite frankly I don’t mind paying a fee that is reasonable. For heavens sake the teller and banker have bills to pay too.

What do you think they do with your $5000? Stick it in a vault? They loan it out to people. They’re already making money off of it (and their overhead gets smaller every year due to technology advances).

How’d they make their money before the fees? Volume?

Maybe capitol one is worth checking out? It seems like an okay deal to me for plain vanilla banking. My credit union has been great relative to the mega-bank we used to use.

Interesting information about modern bank balances. I wonder how many years that data goes back?

Ahh. And it’s much more than that actually. The Fed is still running a number of programs that fund the banks.

I haven’t looked recently, but long ago the story was the banks were supposed to de-lever. Without running a billion-dollar leverage scheme, the burden of operating a bank falls on the customers.

The wisdom of operating for-profit banks with branches on every other corner for plain-vanilla services is what should be questioned.

Privatized the profits of running another leverage scheme, then socialized the losses.

Good job Federal Reserve member banks. Good job.

Whoa! That’s nuts! All I can say to that is apparently BMO treats business banking far different than personal, or your branch is running a rogue program! Here, they bend over backwards to offer zero cost service to us…. if you play by the rules allowing that. That was hard learned after running the gamut with other banks, local or big, and even one credit union years ago. The only problem we ever had is being blacklisted from their e-chat service (some off shore sweat shop I’m sure based on the communication style) when I persisted in cornering an answer out of them. Main bank fixed that right back up.

You leave town for 6 months and then you bitch about junk mail from a bank when you get back? Dude, you need a job and some actual responsibilities

How about when the banks were giving mortgage to every customer and the most of them stop paying them? And it created an housing crisis with so many foreclosure? And finally, the government had to give them money to pay back for all these shitty loans.

Banks had made very poor decision and it is not their customer that should pay for previous executive mistake. And how about their salary?

Exactly, which is why there is no fee if you maintain the minimum balance. If you keep sufficient funds in your account to allow them to make a profit off your money, then no fees. If not, your account is costing them money, so you pay.

I don’t know enough about the details of the banking business model to debate what the acceptable minimum should be, but $5000 does seem high to me.

And for the record, I’ve always banked at credit unions. Being a member is much better than being a customer.

It’s called not having skin in the game and bankers lobbied hard to keep things that way. That’s why Fannie Mae and Freddie Mac are backed by the US taxpayer and almost all mortgages these days are sold to Fannie & Freddie. Why would a big bank want to be on the hook for a customer default when they can get the government to deal with it.

Actually, with quantitative easing (all four rounds), the banks didn’t loan most of the money out; they kept it to improve their capital holdings so they looked robust.

The banks know they can charge extra fees to businesses as we need to handle many more transactions.

They also know that businesses pass all the fees on to their customers. So even if you think you’re getting free checking when they charge high fees for business accounts the businesses you deal with pass it on.

You don’t even want to know about Debit and Credit card fees. We average over 5k a month for transaction fees with Visa/Master Card / AmEx

I wouldn’t work at a bank for any amount of money though. Bank employees (even executives) get treated like crap by the company and have to kiss butt all day. The local branch employees are expected to dress like “professionals” while they are not paid well at all.

oh, mike.

Ken,

20 million x (accounts with just $1500 in them) = $30Billion in assets under management. You can make a LOT of loans wit dat.